hawaii tax id number for rental property

Hawaii tax identification number Rentals Wailuku Maui County HI 96793. The 2022 Hawaii State Legislature passed SB.

Modernizing Rental Car And Peer To Peer Car Sharing Taxes

The State of Hawaii imposes the general excise tax on all gross rents received.

. Date Published 2021-05-04 185900Z. On 3272013 546 PM in Kauai County Di ns asked about ABC Co. Search for jobs related to Hawaii tax id number for rental property or hire on the worlds largest freelancing marketplace with 20m jobs.

If you rent out real property located in Hawaii to a transient person. Apply For Hawaii Tax Id For Rental Property. Kona Office Hilo Office West Hawaii Civic Center Aupuni Center 74-5044 Ane Keohokalole Highway 101 Pauahi Street Suite.

Hawaii County is an Equal Opportunity Provider and Employer. Hawaii Tax Id Number For Rental Property. Hawaii Tax ID Number Changes.

Rental Kihei HI 96753. Call 808 529 1040 now to learn more. If you rent out real property located in Hawaii you are subject to Hawaii income tax and the general excise tax GET.

What it my hawaii. The statewide normal tax rate is 4. In August 2017 Hawaiis Department of Taxation began a modernization project which also included a change in the format of the Hawaii Tax ID numbers.

DeRobert xyz Starting my own Maui County Rental Property In Hawaii small new business. If you are operating a business or practicing a profession as a sole proprietorship in Hawaii received rental income from property located in Hawaii or are operating a farm in Hawaii you. As of August 14.

514 which provides a refund for resident taxpayers who file their 2021 individual tax return Form N-11 on or before December 31 2022. The hawaii state tax id. Its free to sign up and bid on jobs.

The Department of Taxation is moving to a new integrated tax system as part of the Tax System Modernization program. A Other with 0 employees. The GE Taxable Income is all Gross Revenue.

GET is 45 Oahu based on the GE Taxable Income. Hawaiʻi Tax Online is the convenient and secure way to get a State Tax Identification Number BB-1 file tax returns make payments manage your accounts and. But on Oahu Kauai and the Big Island there is a 05.

Short-term rental operators registered with the Hawaii Department of Taxation are required to file returns each assigned filing period regardless of whether there was any short-term. 102022 Information is valid as of1072022 53944 PM. How To Calculate The GET TAT OTAT On Hawaii Rental Income.

Rental Property In Hawaii 96753.

Hawaii Landlord Tenant Laws Updated 2022 Payrent

Hawaii General Excise Tax Everything You Need To Know

Tax Clearance Certificates Department Of Taxation

Printable Sample Rental Application Form Pdf Form Rental Application Real Estate Forms Application Form

How To Start An Llc In Hawaii For 49 Hi Llc Formation Zenbusiness Inc

Hawaii Ge Tax The 10 Most Frequently Asked Questions

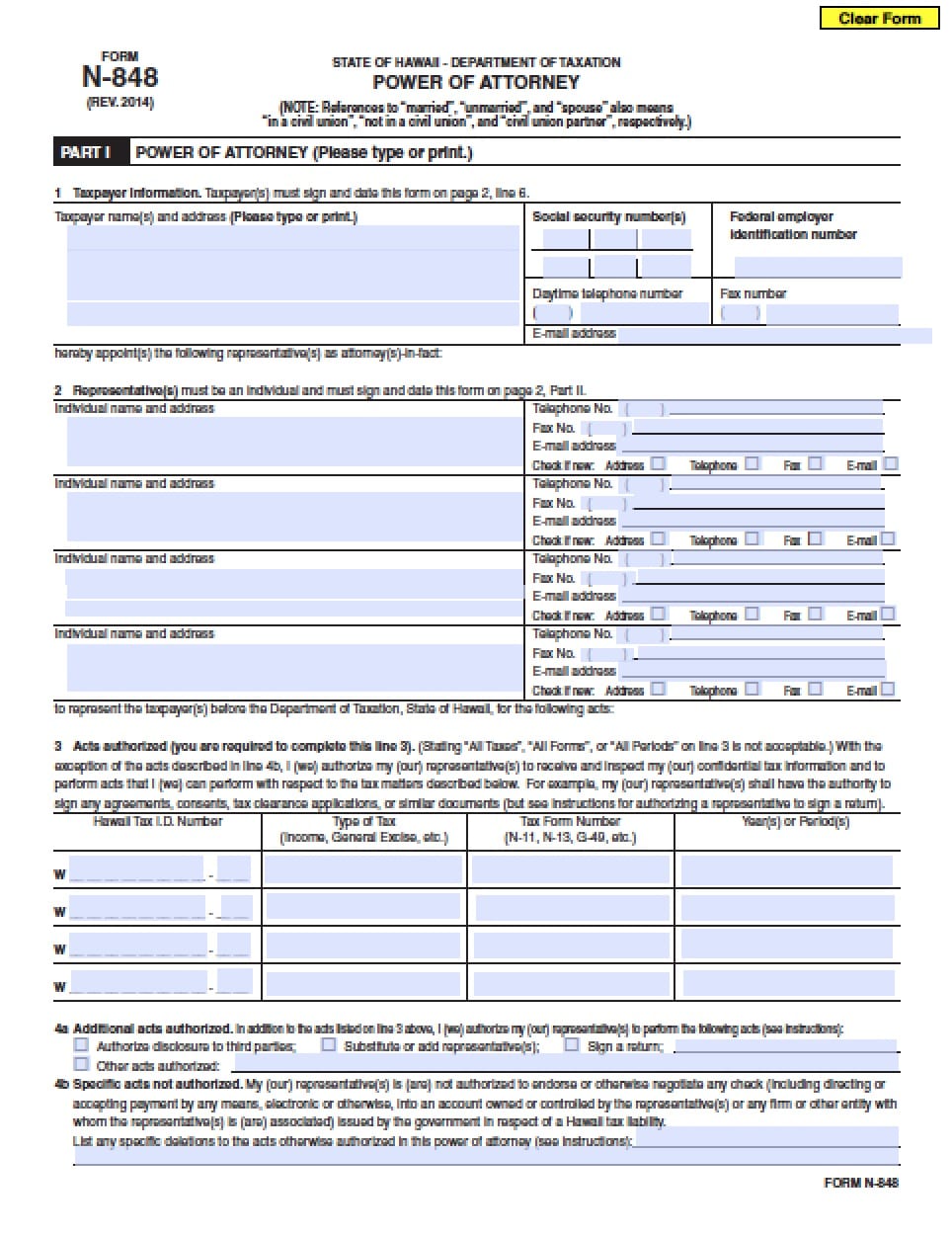

Hawaii Tax Power Of Attorney Form Power Of Attorney Power Of Attorney

Free Hawaii Tax Power Of Attorney Form N 848 Pdf Eforms

Free Hawaii Lease Agreements 6 Residential Commercial Word Pdf Eforms

Free Hawaii Tax Power Of Attorney Form N 848 Pdf Eforms

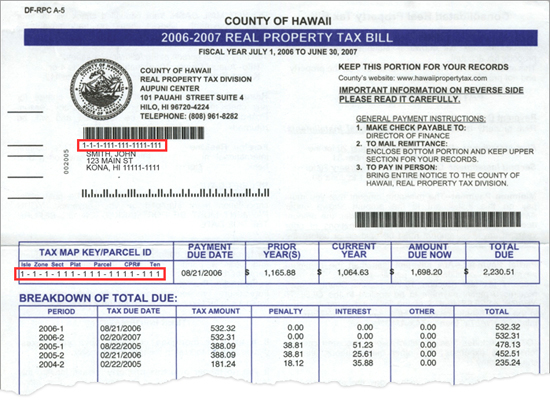

Tax Maps Tmk Maps Hawaii County Hi Planning

County Of Hawai I Online Real Property Tax Payments

How To Start An Llc In Hawaii For 49 Hi Llc Formation Zenbusiness Inc

Maps Hawaii County Hi Planning

Get Tat Otat In Hawaii The Easiest Way To File Pay